OUR SERVICES

WHAT WE DO

Our objective is to help our clients create and effectively deploy excess wealth in a manner that accomplishes their greatest goals, dreams, and desires.

Comprehensive Wealth Management

- Fee Based Financial Planning

- Portfolio and Investment Management

- Cash Flow and Cash Management Services

- Retirement Income Planning

- Tax Planning

- Family and Legacy Planning

- Estate Planning and Insurance

- Special Needs Planning

- Closely Held Business and Succession Planning

- College Funding

Values-based planning

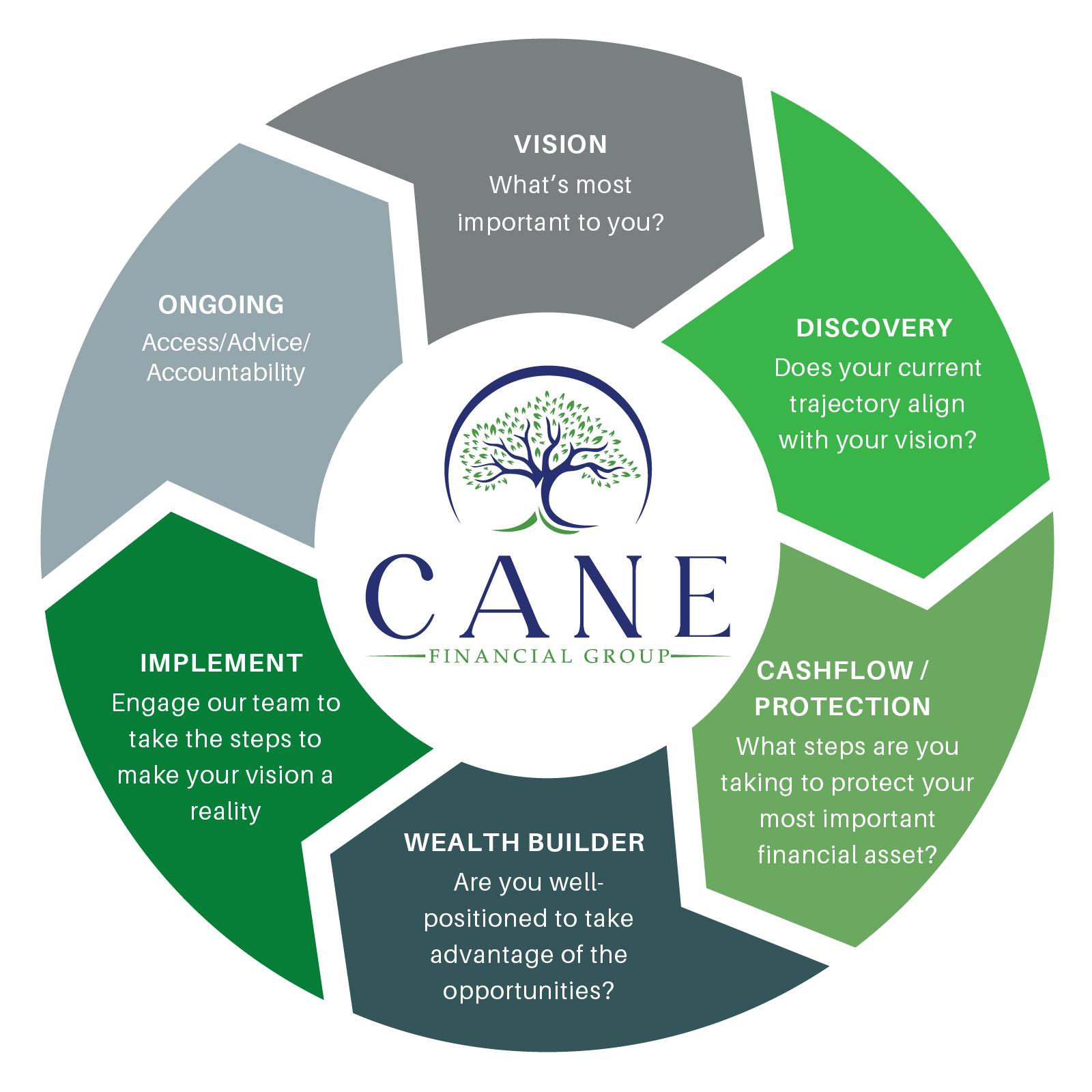

Discovery leads to wise Financial choices

Your unique life experiences and personal aspirations require a financial planning approach rooted in your core values. These values form the foundation of your financial philosophy and guide the development of your customized plan.

Our Financial Discovery process distinguishes two crucial conversations that are often intertwined. Rather than rushing into solutions, we take the time to deeply understand what truly matters to you and why it holds significance.

To achieve this, we employ a concept called The Planning Horizon®. Initially, we delve into what matters most and why it matters to you. Once we gain clarity on these aspects, we collaboratively develop a plan to help you reach your goals.

advanced/estate planning

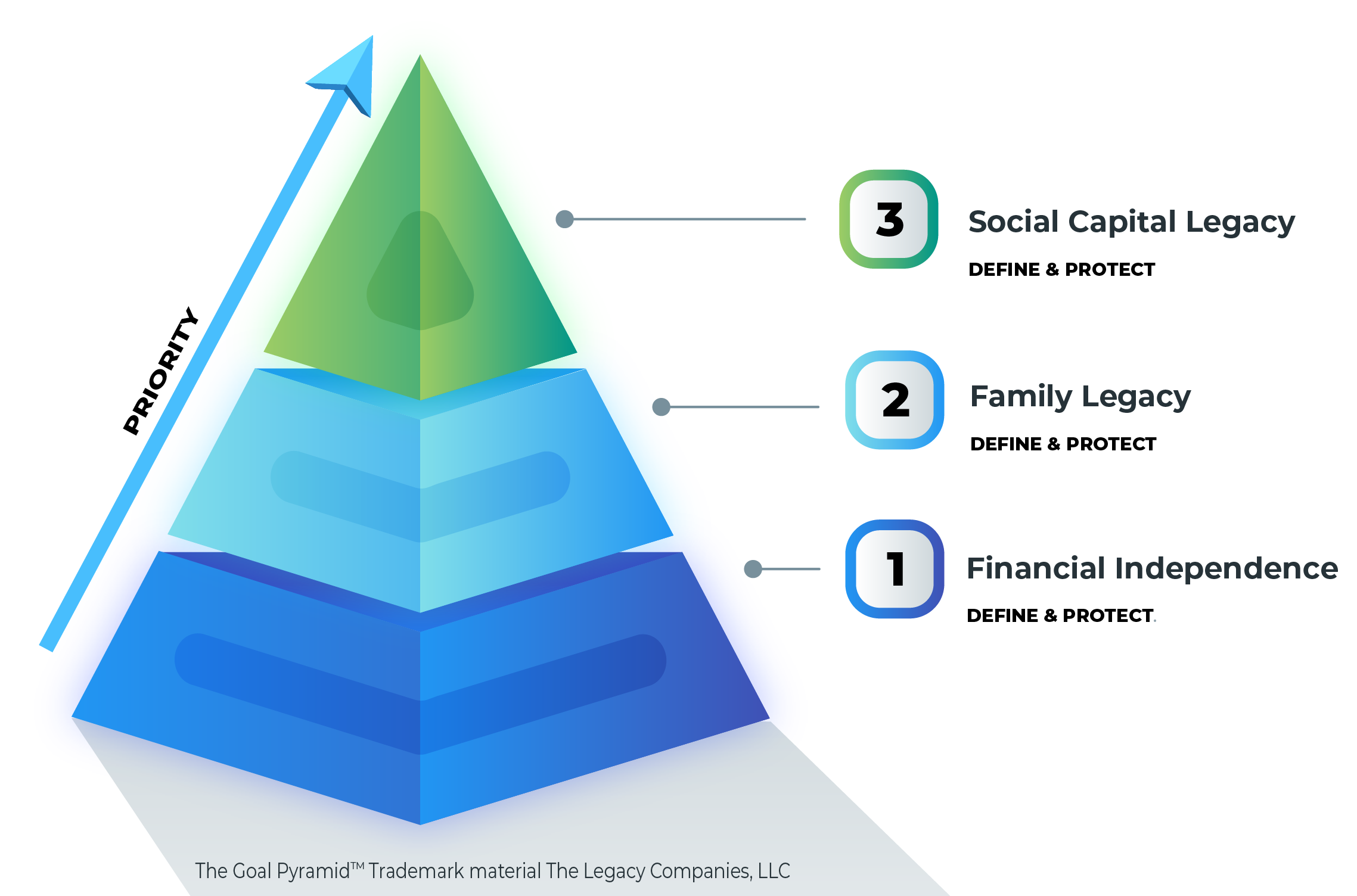

The Three Objectives

01

Financial Independence

For many, working for money is the way of life. From the time you are born until the time you start working, you are financially dependent on work or others to fund your lifestyle. Financial Independence is achieved when your money starts working for you. That’s when you can start buying back your time to live the life you want

02

Family Legacy

Financial Transcendence is the next step after Financial Independence. This is where you can allocate your financial resources to benefit your family and heirs before or after you are gone.

03

Social Capital Legacy

Social Capital Legacy is the desire to have a positive impact on society. Traditionally thought of as philanthropy, this is where you allocate resources to benefit others.